Government has tabled before Parliament, the Income Tax (Amendment) Bill, 2025 that seeks to extend the tax exemption to Bujagali Hydro Power Project up to 30 June 2025.

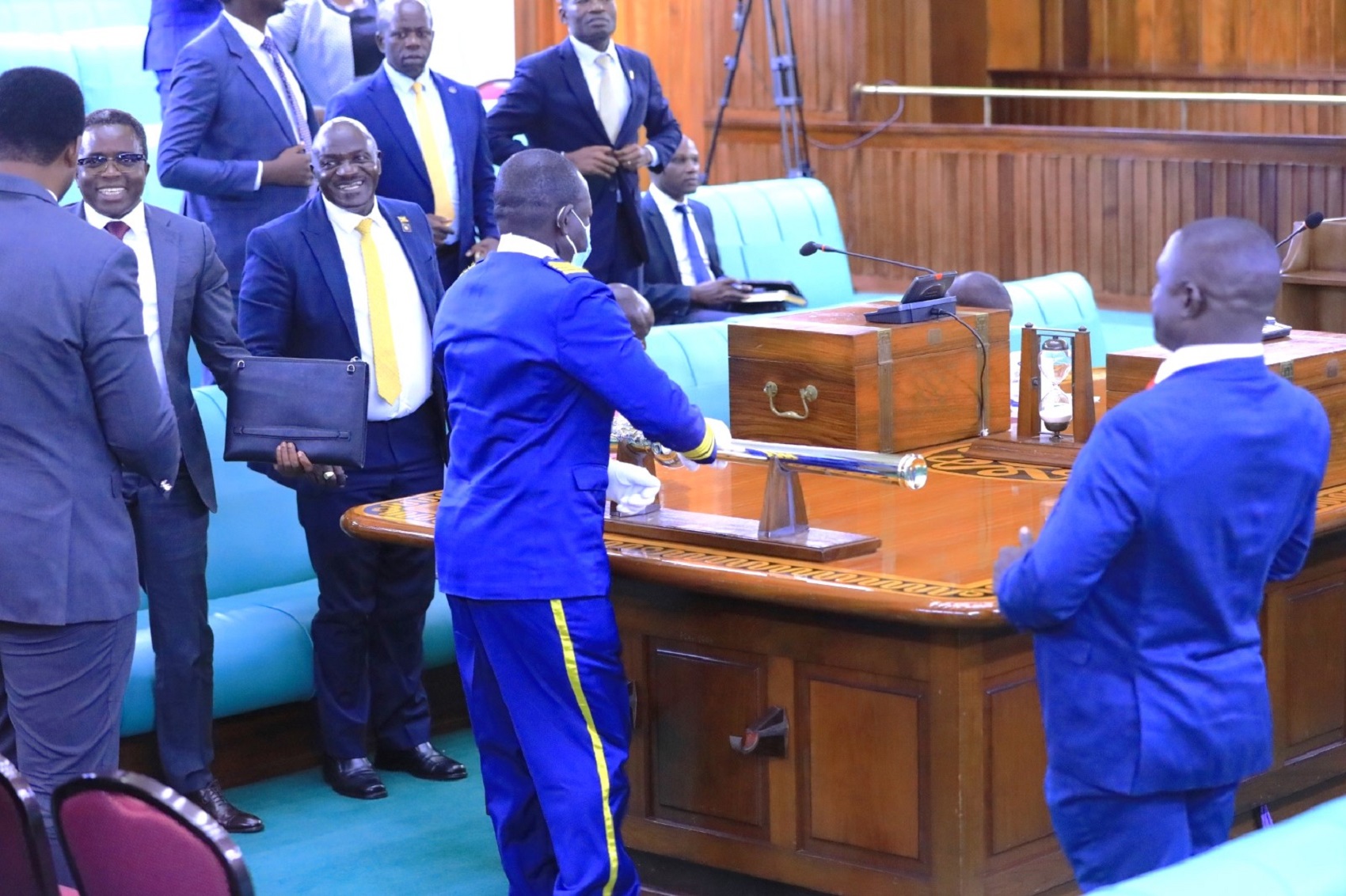

The bill presented by State Minister for Finance (General Duties), Hon. Henry Musasizi on Tuesday, 04 February 2025 seeks to amend section 21 of the Income Tax (Amendment) Bill, 2025 to grant Bujagali a one-year extension.

Musasizi requested Parliament to expeditiously handle the bill and have it concluded within two weeks.

Between 2018 and 2021, government granted the power company similar tax exemptions

However, in 2023 Parliament rejected the request by government to award Bujagali another five-year tax waiver.

At the same sitting chaired by Deputy Speaker Thomas Tayebwa, government also presented the Excise Duty (Amendment) Bill will see an imposition of Shs1500 per litre on un-denatured spirits of alcoholic strength of 80 per cent or more made from locally produced raw materials.

The bill also imposes Shs1700 per litre on locally produced spirits of alcoholic strength by volume of less than 80 per cent.

Un-denatured alcohol is ethanol that has not been mixed with other substances to make it unsafe for human consumption. It is a colourless, flammable liquid with many uses in science, medicine, and manufacturing.