The Minister of State for Internal Affairs, Gen. David Muhoozi, has said that the heightened crack down on money lenders who confiscate national identifications (IDs) as collateral has so far led to recovery of 149 IDs.

Muhoozi said that the recoveries were made following an operation conducted by police in the North Kyoga Region in Lira City, targeting money lending companies on 05 August 2024.

“The law enforcement agencies prosecute such cases where lenders are found to be engaging in such blatant illegal practices of confiscation of national IDs,” Muhoozi said.

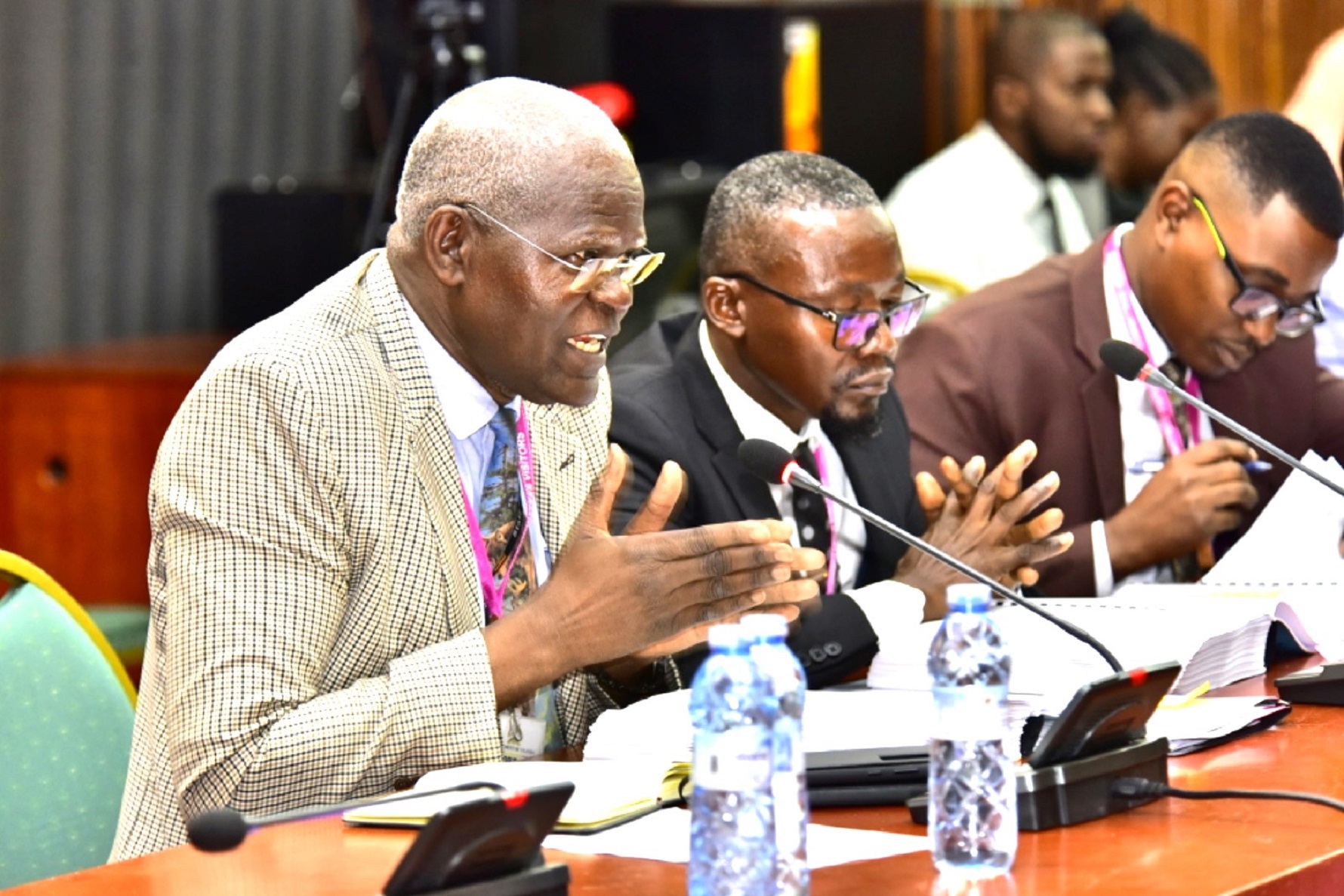

He made the revelation on Wednesday, 23 October 2024 in response to a matter of national importance raised by Hon. Mourine Osoru over the increasing confiscation of national IDs from borrowers by money lenders.

Muhoozi faulted national ID card holders saying that they are complicit in the illegal practice because they do not report the cases to police or National Identification Registration Authority (NIRA).

“To achieve this, the citizens must cooperate by avoiding this illegal practice or in the unlikely event that it happens, report to the authorities to retrieve the confiscated cards,” Muhoozi said.

He reiterated that Section 77 (b) of the Registration of Persons Act, Cap. 332 prohibits a person without authority from depriving someone off his/her national ID.

The minister said that the national identification is the property of government and therefore, a money lender has no authority to deprive a person of the same.

“Government did not intend national identity cards to be used as collateral for borrowing but rather as identification documents to foster social and economic development in the country,” Muhoozi added.

The minister further cited the Money Lenders Regulations, Statutory Instrument No.8 of 2018, which expressly prohibits the demand or acceptance of a national identity card or other document establishing the identity or nationality of holder as collateral for any money advanced to a borrower as a loan.

“Therefore, any money lender found in violation of these laws and regulations, is in breach of the law and if convicted is liable to suffer severe penalties, including the revocation or non-renewal of their operating licenses, payment of fines, and imprisonment,” he said.

Muhoozi also re-echoed government’s plan to upgrade the IDs by introducing digital identification cards.

“With digital verification, citizens will be able to authenticate their identity using electronic means, such as mobile apps or online platforms. This planned shift reduces the risk of physical IDs being used as collateral since digital identity verification does not require the physical handover of the card,” he said.

Muhoozi added, “Government is cognizant of the fact that that majority of its citizens do not yet have access to internet and smart phones to enable the immediate implementation of a universal digital ID system. However, when this happens, it will be the ideal solution to decisively deal with this challenge.”

Speaker Anita Among however, demanded that the Minister of Finance, Planning and Economic Development presents regulations to operationalise the Tier IV Microfinance and Money lenders Act to curb money lending interest rates.

“We had asked the Minister of Finance to bring regulations because that is the most important thing, we want regulations. We have a law without regulations so we cannot implement the law. The issue of money lenders is very serious,” she said.

The Minister of State for Finance, Planning and Economic Development (Microfinance), Hon. Haruna Kasolo, said that the Attorney General is in the process of drafting the regulations, adding that they will be ready in a month’s time.